Frequently Asked Questions about Customs Provisional Registration

01

Question: Charities such as the Red Cross need to register with the customs to handle the import business of epidemic prevention and control materials. What type of registration should be handled?

Answer: Mass organizations and social organizations such as the Red Cross belong to non-market entities and do not have business licenses. If they need to handle import and export business, they can go to the local customs for temporary registration. Among them, the registration of enterprises in Shenzhen area is handled by Fuzhong Customs (Address: 50-54 customs window, East Hall, Shenzhen Administration Service Hall, Civic Center, Fuzhong Third Road, Futian District, Shenzhen); the registration of enterprises in Huizhou area is handled by Huizhou Customs (Address (1st floor, Huizhou Customs Building, 279 Zhongkai Avenue, Zhongkai High-tech Industrial Zone, Huizhou City).

Guidance from the General Administration: During the period of epidemic prevention and control, if you cannot apply online or encounter inconvenience to conduct business on the spot due to network problems, after obtaining the consent of the customs, you can send the "Registration Form of Customs Declaration Units" by mail, fax, etc. When it is sent to the customs, the customs will register it first, and the relevant materials can be resubmitted according to the customs requirements after the epidemic situation.

02

Q: What materials should be submitted for temporary registration?

Answer: To apply for temporary registration, you should submit the Registration Form of Customs Declaration Units, the certificate of delegation or authorization issued by your unit, and the proof of non-trade activities. Among them, non-tradable activity certification materials can be issued by the unit itself during the fight against the epidemic.

03

Q: How long does it take for temporary registration?

Answer: The materials submitted by the applicant are complete and valid. In general, the customs office should complete the settlement.

04

Q: What documents will be issued by the customs after the temporary registration?

Answer: For temporary registration, the customs will not issue a registration certificate, but may issue a temporary registration certificate. As long as the temporary registration has been completed and is still within the validity period, whether or not you hold a temporary registration certificate issued by the customs does not affect the normal processing of import and export business.

05

Q: How to check whether the temporary registration has been registered at the customs?

Answer: The customs publicizes the registration record information and credit rating information of all enterprises and other units registered or filed with the customs through the "China Customs Enterprise Import and Export Credit Information Disclosure Platform" (website: http://credit.customs.gov.cn) And administrative penalty information.

06

Q: After applying for temporary registration, to which customs can I handle business?

Answer: After the temporary registration, you can handle import and export business with all customs in the country.

07

Q: How long is the temporary registration valid?

Answer: The temporary registration is valid for one year. After the expiry of the valid period, the temporary registration shall be re-registered.

08

Q: Can units that have already registered for temporary registration be able to go through customs declaration business by themselves?

Answer: Temporary registration can be used as the "domestic consignee" of imported goods or "domestic consignor" of exported goods, but it cannot be used as a "declaration unit" and cannot declare to the customs by itself. Units that have already undergone temporary registration shall entrust customs declaration enterprises to handle customs declaration business with the customs.

A customs declaration enterprise is an enterprise that is approved by the customs for registration, accepts the entrustment of consignees and consignors of import and export goods, and handles customs declaration services with the customs to engage in customs declaration services.

09

Q: What code should I use to handle customs business after applying for temporary registration?

Answer: Like all levels of Red Cross, various foundations, etc. currently have a unified social credit code, they should use their own unified social credit code for temporary registration. After completing the temporary registration, the customs will also issue a 10-digit temporary registration code. Temporary registration units can use a unified social credit code or a 10-digit temporary registration code for customs declaration.

10

Q: How do I fill in the inspection and quarantine code when the temporary registration unit declares?

Answer: When the temporary registration unit declares at customs, the 10-digit inspection and quarantine code fills in the special inspection unit code in accordance with unified rules. The specific rules are the first two digits of the provincial administrative division code plus 8 "0" s. For example, the Shenzhen Red Cross in Guangdong Province, the first two digits of the provincial administrative division code of Guangdong Province are "47", then 10 Enter "4700000000" for the inspection and quarantine code.

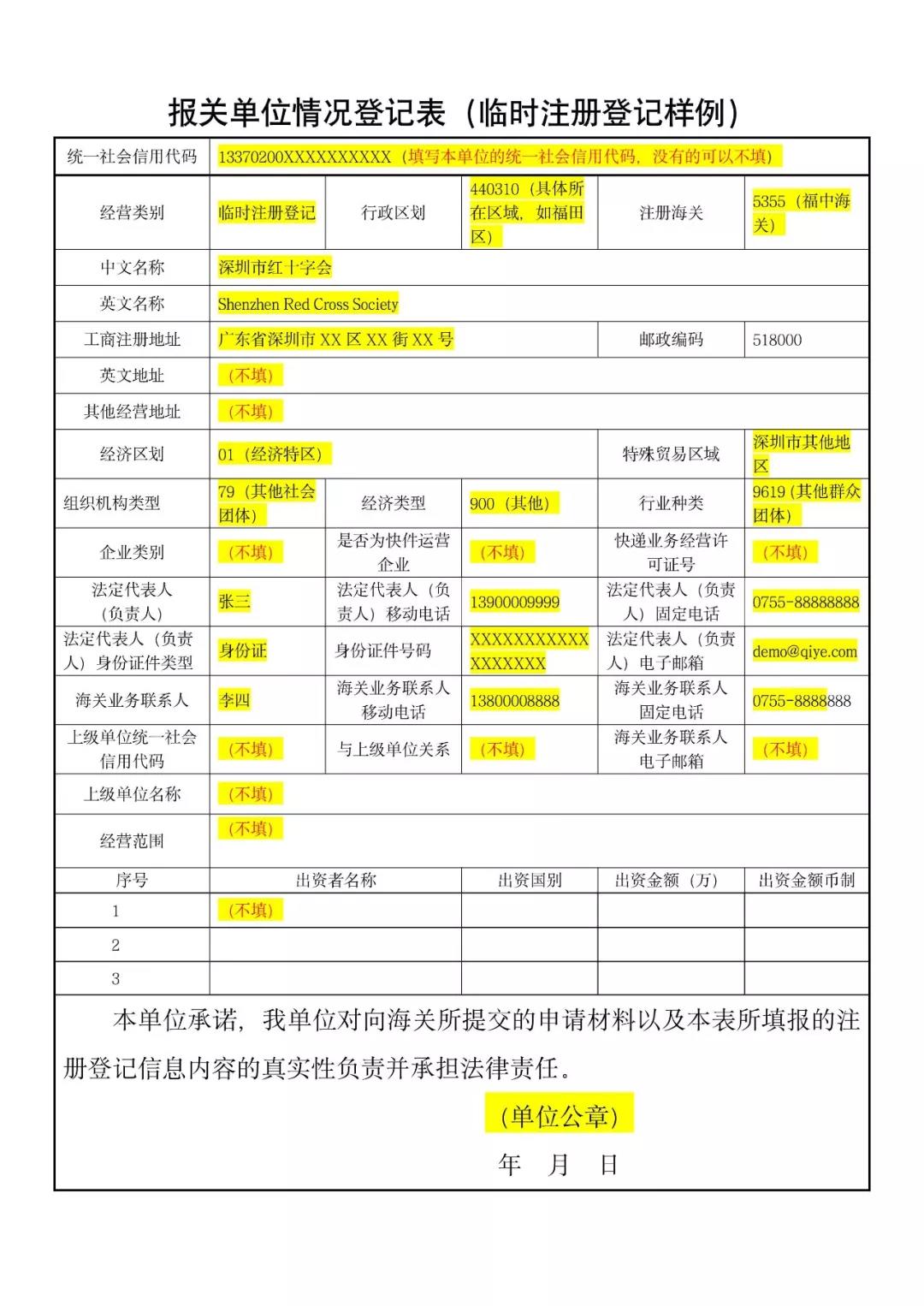

Attachment: "Temporary Registration Form of Customs Declaration Units" Sample of Temporary Registration